TL;DR: A CBD:THC ratio rule is one of the few regulatory levers that can reduce intoxication risk without banning “hemp-derived THC” products outright. If policymakers adopt a CBD:THC ratio framework (instead of a hard ban or strict THC caps alone), hemp-derived CBD demand could rise because every milligram of THC sold would effectively require a minimum amount of CBD in the same finished product. That outcome is plausible—not certain—because Congress and regulators could choose other frameworks (per-serving caps, per-container caps, “total THC” redefinitions, or enforcement-driven shutdowns).

Why a CBD:THC ratio is on the table

Policymakers are under pressure to address intoxicating hemp products that exist outside state-regulated cannabis systems. The issue isn’t abstract: dose, labeling, youth access, synthetics, and inconsistent lab methods have turned “hemp” into a consumer product category that often behaves like marijuana—but without the same guardrails.

A CBD:THC ratio is attractive to regulators because it sounds like a safety mechanism that still leaves a “lawful lane.” It’s the classic compromise move: tighten the rules while avoiding a headline that says “Congress banned hemp drinks.” If the politics demand something that looks like consumer protection and avoids a total shutdown, a CBD:THC ratio becomes a realistic option.

Separately, the federal government has already signaled it wants tighter frameworks for hemp-derived cannabinoid products. See the White House executive order on “Increasing Medical Marijuana and Cannabidiol Research,” which explicitly calls for developing frameworks around hemp-derived cannabinoid products (including concepts like THC-per-serving and ratios):

INCREASING MEDICAL MARIJUANA AND CANNABIDIOL RESEARCH (White House).

What a CBD:THC ratio means (in plain English)

A CBD:THC ratio rule requires a product containing THC to include a minimum amount of CBD relative to THC. Examples:

A CBD:THC ratio rule requires a product containing THC to include a minimum amount of CBD relative to THC. Examples:

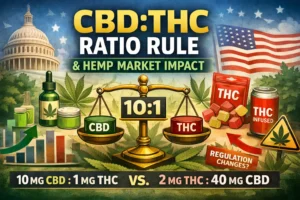

- 10:1 CBD:THC ratio = for every 1 mg THC, the product must include at least 10 mg CBD

- 20:1 CBD:THC ratio = for every 1 mg THC, the product must include at least 20 mg CBD

This is not a “THC cap” by itself. It’s a formulation requirement. A CBD:THC ratio can be layered on top of THC-per-serving limits, age gating, labeling rules, and testing standards.

Why it matters commercially: a CBD:THC ratio converts THC demand into forced CBD throughput. If THC products remain legal but must be “balanced” with CBD, then CBD inputs per unit can jump dramatically—even when THC doses remain small.

The math: why ratios can drive CBD throughput

Here’s the core mechanism: a CBD:THC ratio increases required CBD per product at the exact moment policymakers are likely to push THC doses down. That combination (low THC + mandated CBD) is how you get higher CBD volume even in a stricter regulatory world.

Scenario A: “THC-only” beverage (today’s common format)

- 5 mg THC

- 0 mg CBD

- Total cannabinoids per unit: 5 mg

Scenario B: 20:1 CBD:THC ratio (same THC dose)

- 5 mg THC

- 100 mg CBD (5 × 20)

- Total cannabinoids per unit: 105 mg

Comparative effect: 105 mg vs 5 mg = 21× more cannabinoid input per unit without selling one extra can.

Scenario C: THC gets capped lower, but the CBD:THC ratio still applies

- 2 mg THC cap

- 20:1 CBD:THC ratio → 40 mg CBD

- Total cannabinoids per unit: 42 mg

Comparative effect: 42 mg vs 5 mg = 8.4× more cannabinoid throughput per unit (42 ÷ 5).

Where it gets wild: edibles and multi-serving packages

Ratios are “CBD-hungry” when THC is sold in larger package totals. If a product contains 50–100 mg THC per package (common in some markets), a CBD:THC ratio can force CBD grams per package, not milligrams. That’s not necessarily “good” for consumers or formulation cost—but it is how CBD demand can surge if the category remains legal.

| Example | THC per package | CBD:THC ratio | CBD required |

|---|---|---|---|

| “Balanced” gummy pack | 50 mg | 10:1 | 500 mg CBD |

| Higher-dose pack | 100 mg | 20:1 | 2,000 mg CBD (2 g) |

Important constraint (don’t ignore this): the math above only translates into higher CBD demand if the product category survives and consumers keep buying. Regulators can absolutely pick a framework that shrinks the entire market (or pushes it into state-licensed cannabis), which could reduce total unit volume even if CBD-per-unit rises.

Comparatives: ratio vs caps vs “total THC”

1) CBD:THC ratio (formulation guardrail)

What it does well: pushes products toward “balanced” formulations; easy political messaging (“less intoxicating”); can be paired with testing and labeling.

Where it fails: it doesn’t automatically solve serving-size gaming, misleading marketing, or synthetic cannabinoid risk. It also raises cost and formulation complexity—especially at higher ratios.

Bottom line: If a lawful lane survives, CBD:THC ratio rules can structurally increase CBD throughput.

2) THC-per-serving / THC-per-container caps (dose guardrail)

What it does well: simple to understand; relatively straightforward to enforce and message; directly targets intoxication risk.

Where it fails: caps alone do not force CBD demand. They can also function as a soft ban if set too low, especially for edibles.

Bottom line: Caps can shrink the market; they only boost CBD demand if paired with a CBD:THC ratio requirement.

3) “Total THC” redefinitions (measurement guardrail)

What it does well: closes loopholes where “pre-THC” forms convert into intoxicating THC after heating; aligns with the reality that consumers experience “total potential THC,” not just delta-9 at the moment of sale.

Where it fails: measurement fights (testing methods, decarb assumptions, lab variance) and litigation risk. It may also collapse major segments (e.g., THCA flower) rather than regulate them.

Bottom line: “Total THC” moves are more likely to eliminate gray products than to create a balanced-product lane.

If you want a deeper legal backdrop on how cannabinoid dosing concepts (including balancing cannabinoids) affect consumer experience and regulation narratives, Cannabis Industry Lawyer has a practical discussion that frames ratio thinking in consumer-dose terms:

how CBD:THC ratio affects cannabis dosage and consumer response.

How it could happen (and why it might not)

Plausible pathways (how a CBD:THC ratio could become a real rule)

- Federal definition of lawful “final products” gets rewritten to include dose standards, and a CBD:THC ratio becomes the “safe harbor” category that survives while high-intoxicating SKUs get pushed out.

- Agency-driven framework development (especially if Congress punts details) that favors “balanced” formulations because they’re easier to defend politically as harm reduction.

- Enforcement posture + retailer standards where major distributors and payment rails treat ratio-compliant products as lower-risk, creating de facto market standards even before Congress codifies them.

Real reasons it might not happen

- Congress may choose blunt caps or near-prohibition instead. If the political temperature is “protect kids at all costs,” ratio nuance may lose to simple THC ceilings.

- Regulators may focus on per-serving THC limits because it’s easier to message than a formula requirement.

- Industry politics will distort the outcome. Alcohol, hemp, and state-licensed cannabis stakeholders rarely agree on what “consumer safety” should mean, so the final rule can reflect horse-trading rather than logic.

Bottom line on certainty: A CBD:THC ratio is a credible compromise tool, but it’s not inevitable. Treat it as a scenario worth planning for, not a prediction you can underwrite.

Operator playbook: build for multiple regulatory outcomes

If you’re operating in hemp-derived cannabinoids, your best strategy is not betting on one outcome. It’s building a business that can survive any of the likely frameworks: caps, ratios, “total THC,” tougher labeling, and selective enforcement.

1) Build “ratio-ready” formulations (even if you don’t sell them yet)

Have at least one product line that could comply with a CBD:THC ratio (10:1, 20:1) and still taste acceptable, remain shelf-stable, and pencil out economically. If the market pivots quickly, “already compliant” wins shelf space while everyone else reformulates.

2) Contract like regulators will change the rules mid-quarter

Regulatory volatility is not a theory; it’s the operating environment. Your supply agreements, tolling/manufacturing contracts, and distribution terms need clear change-in-law provisions, testing responsibility allocation, and remedies.

Start with the basics if you touch farm products and proceeds. These two concepts show up fast when money is tight and counterparties default:

- notice requirements for buyers of farm products (so liens don’t vanish when product moves)

- how security interests can attach to crop proceeds and related intangibles (because “proceeds” is broader than most people think)

3) Protect the brands that survive tighter enforcement

If the market tightens, compliance-heavy brands with credible IP and documentation outlive “gray shelf” products. If you sell hemp/CBD lines that could survive a CBD:THC ratio regime, you should treat your IP as an asset, not decoration:

how trademarks and hemp-adjacent brand protection work in practice

4) Don’t confuse “possible” with “profitable”

Yes, a CBD:THC ratio can increase CBD inputs per unit. No, that does not guarantee profits. Ratios can increase COGS, make formulation harder, and shrink the addressable consumer base if effects feel too mild or too expensive. Your win is flexibility: the ability to pivot SKUs, distribution, and claims quickly without torching capital.

FAQ

What is a CBD:THC ratio?

A CBD:THC ratio is a formulation rule requiring a minimum amount of CBD relative to THC (for example, 10:1 or 20:1). In practice, it means each milligram of THC must be paired with a specified minimum amount of CBD.

Would a CBD:THC ratio increase hemp demand?

It can. A CBD:THC ratio can force significantly higher CBD inputs per unit sold, which can increase hemp-derived CBD throughput. But total demand depends on the legal outcome (caps vs bans vs safe harbor) and consumer response.

Is a CBD:THC ratio the most likely outcome?

Not necessarily. It’s a plausible compromise. Policymakers may instead choose strict THC-per-serving limits, redefine “hemp final products,” adopt “total THC” concepts, or use enforcement to shrink the category.

What should operators do right now?

Build at least one ratio-compliant product pathway, tighten change-in-law contract provisions, and stop running the business as if today’s loopholes will exist next year. Hope is not a strategy; optionality is.

Conclusion: The CBD:THC ratio is one of the few regulatory tools that can plausibly preserve a lawful lane while addressing intoxication risk. If adopted, it can mechanically increase CBD demand by forcing CBD throughput per milligram of THC sold. But it is not certain, and alternative frameworks could shrink the overall market. Strategically, the best move is to build ratio-ready products and contracts that can survive multiple regulatory outcomes.

Call to action: If you want a “ratio-ready” compliance + commercial plan (formulation targets, testing language, supply contract protections, and a pivot strategy for caps vs ratios vs total-THC outcomes), add your consult link here.